Wisely

A Financial Literacy App

for Teens

PROJECT TYPE

Google UX Design Certificate project

TIMELINE

6 Weeks

TARGET AUDIENCE

Teens aged 13 – 18

ROLE

UX Designer

RESPONSIBILITIES

Conducting User Interviews

Paper & Digital Wireframing

Low & High-Fidelity Prototyping

Conducting Usability Studies

Accounting for Accessibility

Iterating on Designs

TOOLS

Figma

Miro

PROBLEM

Teenagers who want to learn about money and personal finance need a way to learn about it independently so they don't need to rely on their parents or schools to teach them.

With rising levels of student loan debt, credit card debt, and the percentage of US citizens living paycheck-to-paycheck, financial literacy is more important than ever to ensure that young people do not fall into the same trap.

GOAL

Create a fun, easy-to-use financial literacy app for teens that will allow them to learn independently about personal finance so they can feel empowered to make smart financial decisions that will ensure their future success.

Offer a free version of the app and make it accessible either via mobile device or web browser to reach the broadest range of users of different abilities and income levels.

EMPATHIZE

User Research

—

USER SURVEYS AND REPORTS

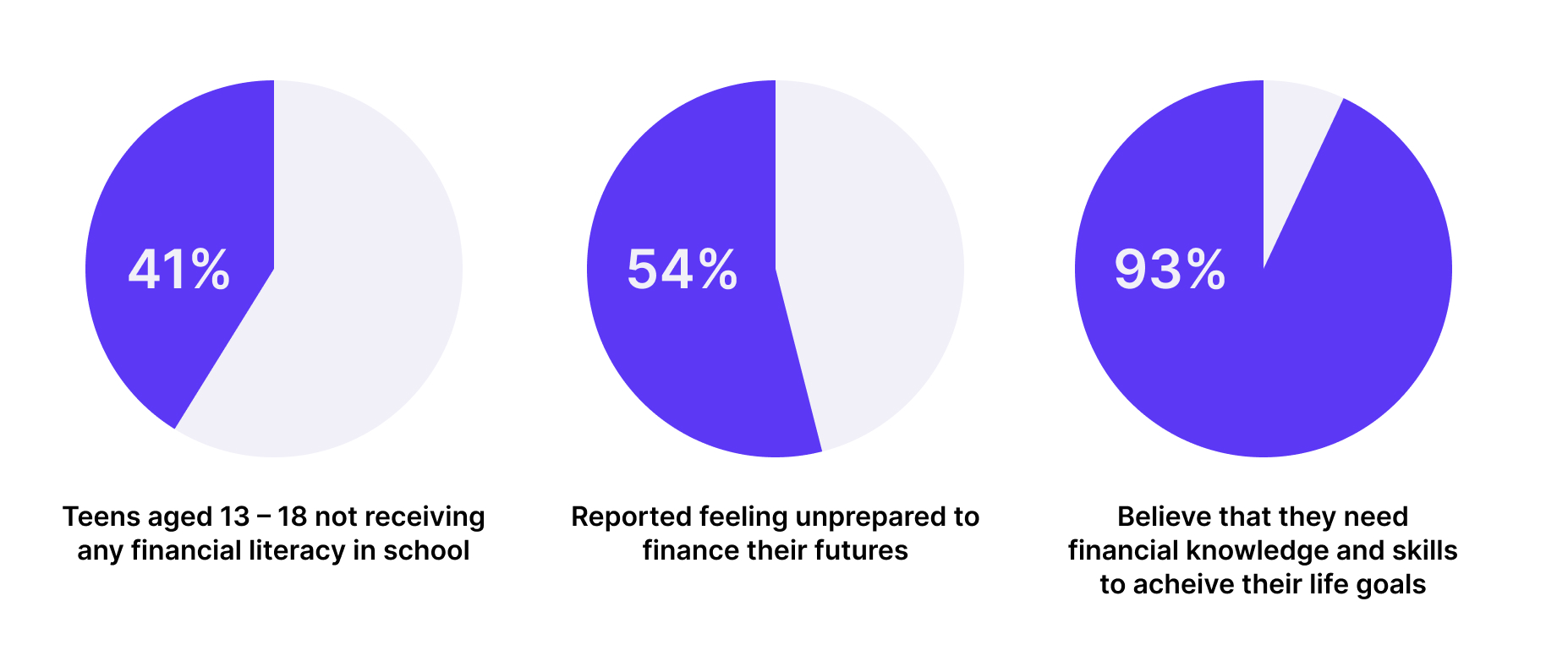

To begin my research, I gathered data by reading through surveys and reports on teens & personal finance that were conducted within the last year. I learned that 41% of teens aged 13 – 18 were not receiving any financial literacy education in school and that 54% reported feeling unprepared to finance their futures. Many teens reported feeling eager to learn more about personal finance and expressed that having a better understanding of how to pay for college, how student loans work, how to create a budget, and how to save effectively would help ease their concerns.*

*Source: Junior Achievement USA and Citizens Bank 2022 Teens & Personal Finance Survey

KEY FINDINGS

LACK OF FINANCIAL LITERACY EDUCATION

Currently, only 27 states require schools to offer a personal finance course, but only 15 states require students to take the course to graduate high school. This means that nearly half of all states in the US provide no financial literacy education to students whatsoever.

DEMAND, BUT LACK OF FINANCIAL LITERACY APPS FOR TEENS

93% of teens believe they need financial knowledge and skills to achieve their life goals, but only 2 out of the 5 personal finance apps analyzed during a competitive audit were found to offer an education component and only one of these apps was designed for teens.

INFORMATION EMPOWERS AND EASES FEARS

40% of teens reported that having a better understanding of how to pay for college, how student loans work, how to create a budget, and how to save effectively would help ease their concerns. Educating teens on personal finance can help them to make smart decisions in the future.

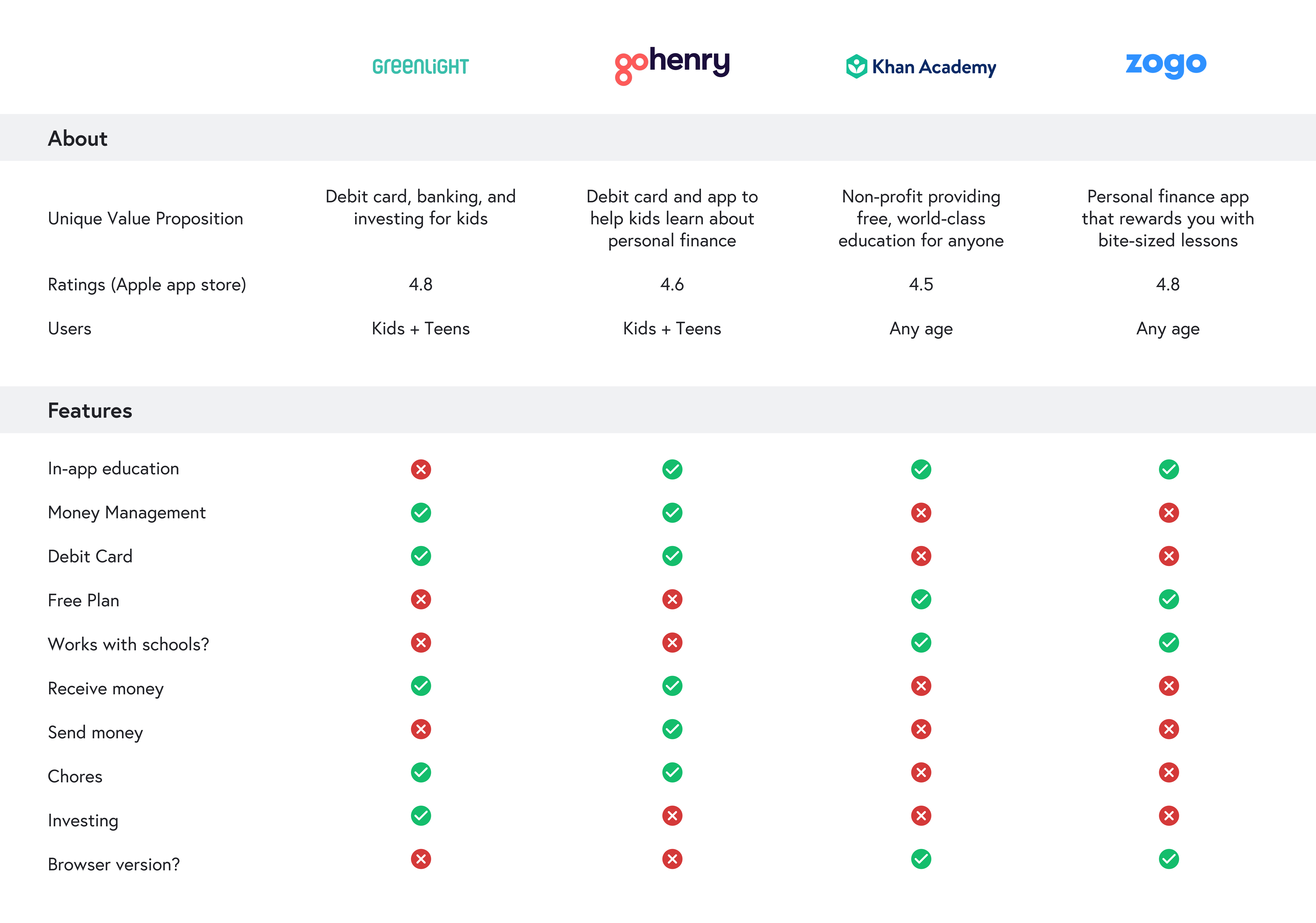

COMPETITIVE AUDIT

My next step was to conduct a competitive audit. My findings revealed that only one app out of the six that were analyzed offered both an education component, as well as a banking component. Additionally, the app that did offer both components did not offer a free version and was quite costly, thereby making it inaccessible to low-income users.

OPPORTUNITIES

EDUCATION + REAL WORLD PRACTICE = HIGHER SUCCESS RATE

Only 1 out of the 6 apps analyzed offered both an education and a banking component. It is important for teens to practice what they are learning and to have room to make mistakes early in life when the consequences are smaller so this app should offer both components.

REDUCE FINANCIAL BARRIERS

The high cost of many financial literacy apps makes them inaccessible to low-income teens and families. The Wisely app could be offered on a tiered pricing system with a free education-only version and paid education and banking version. Wisely could also partner with schools to incorporate lessons into the school's curriculum.

OFFER A BROWSER-BASED VERSION FOR BROADER ACCESSIBILITY

To further broaden the app's reach, there could be a browser-based version that could be accessed at school or in a library so teens who don't own a mobile device could access the educational content for free.

DEFINE

User Persona & Journey Map

—

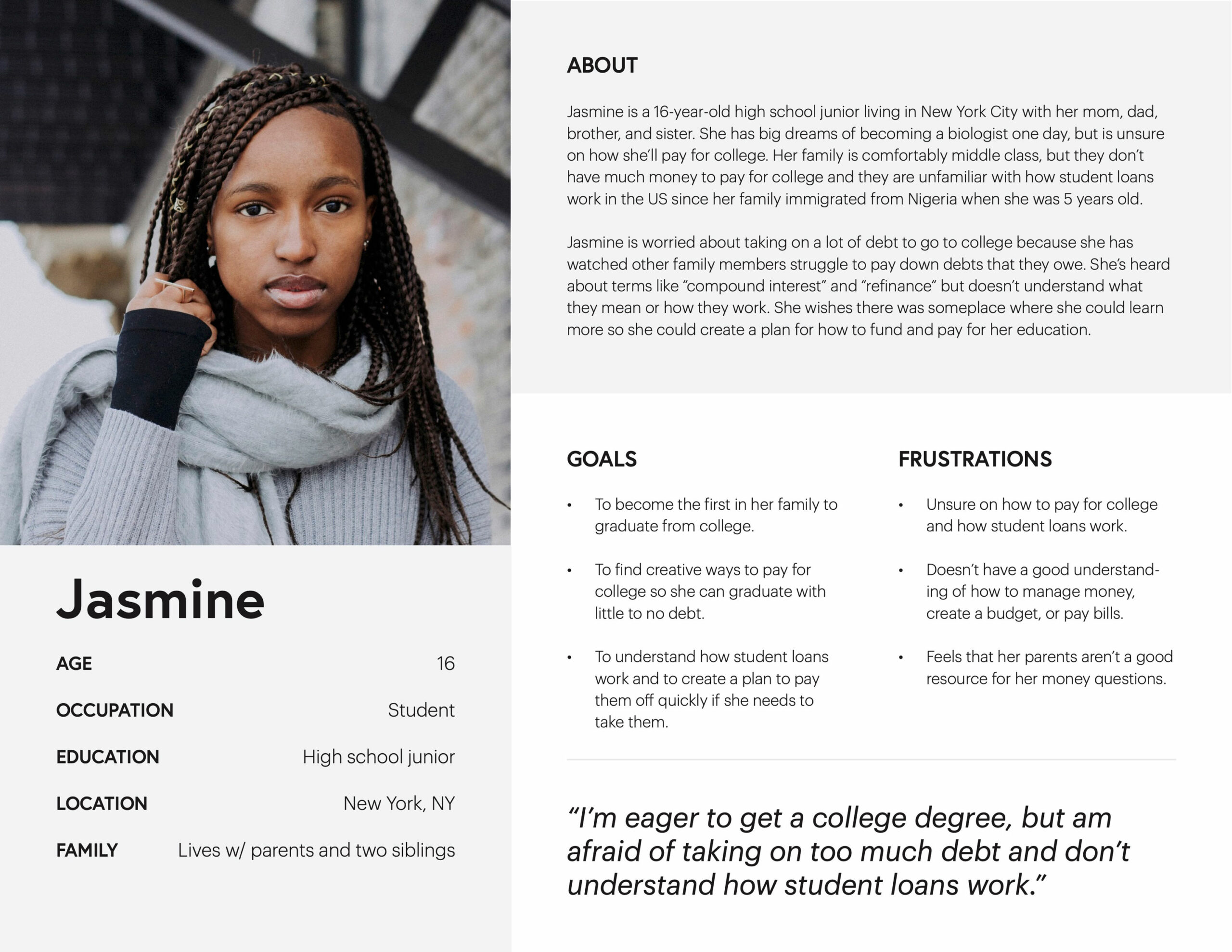

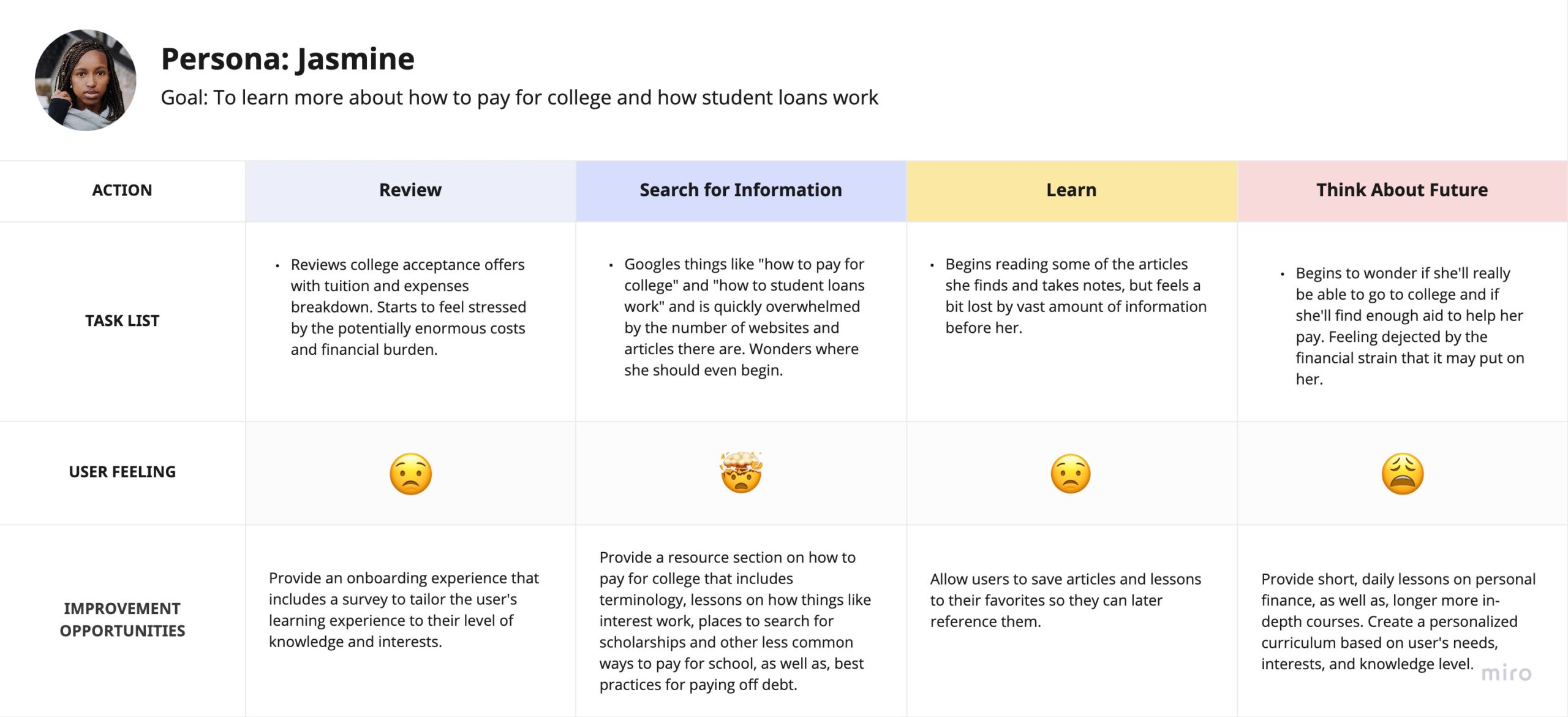

To further identify improvement opportunities and to guide my decision making, I developed a user persona and mapped his user journey.

PROBLEM STATEMENT

Jasmine is a high school junior who needs to learn about ways to pay for college and how student loans work because she doesn’t know what her options are and is worried about taking on a lot of debt.

IDEATE

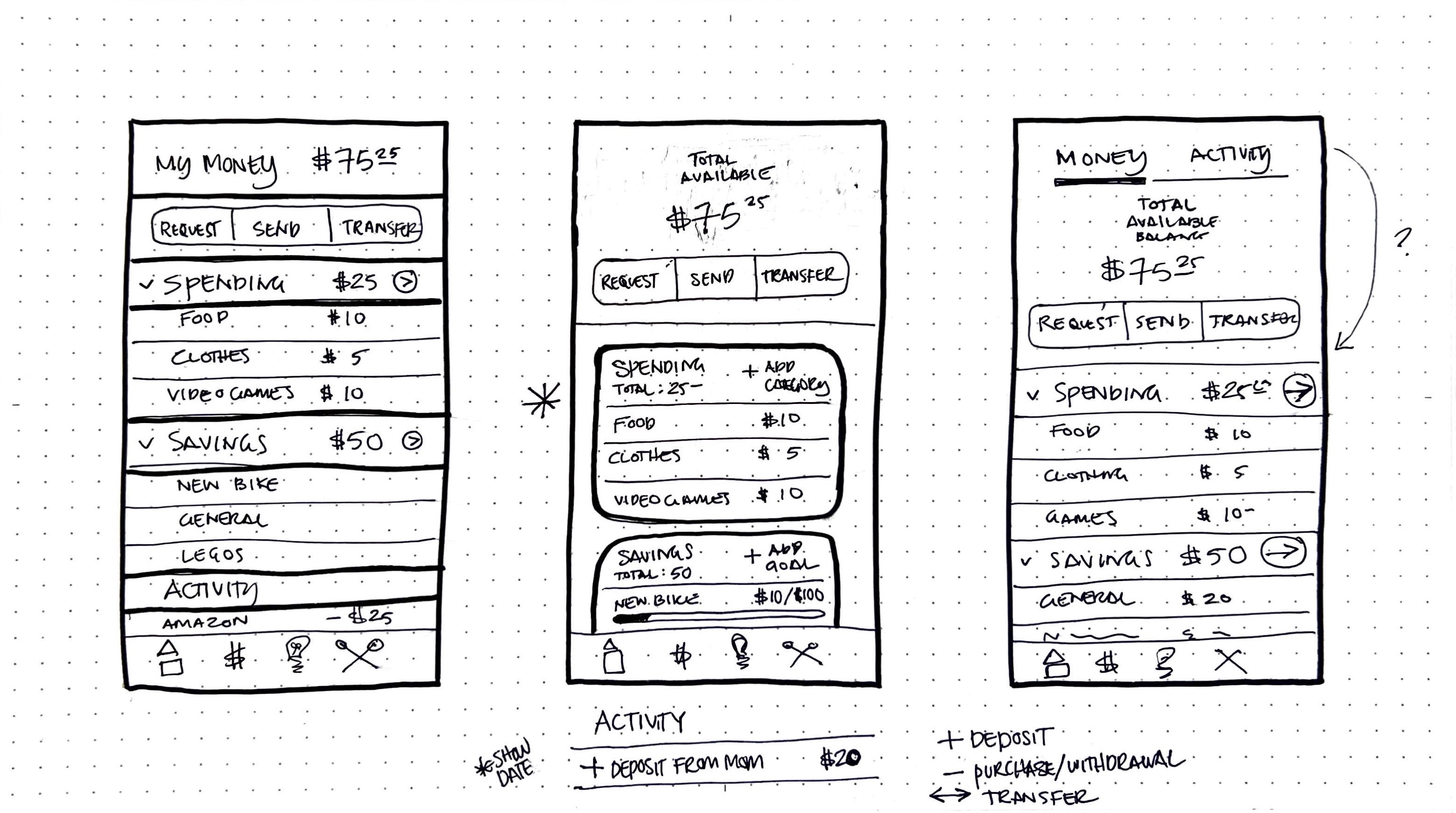

Paper Wireframes

—

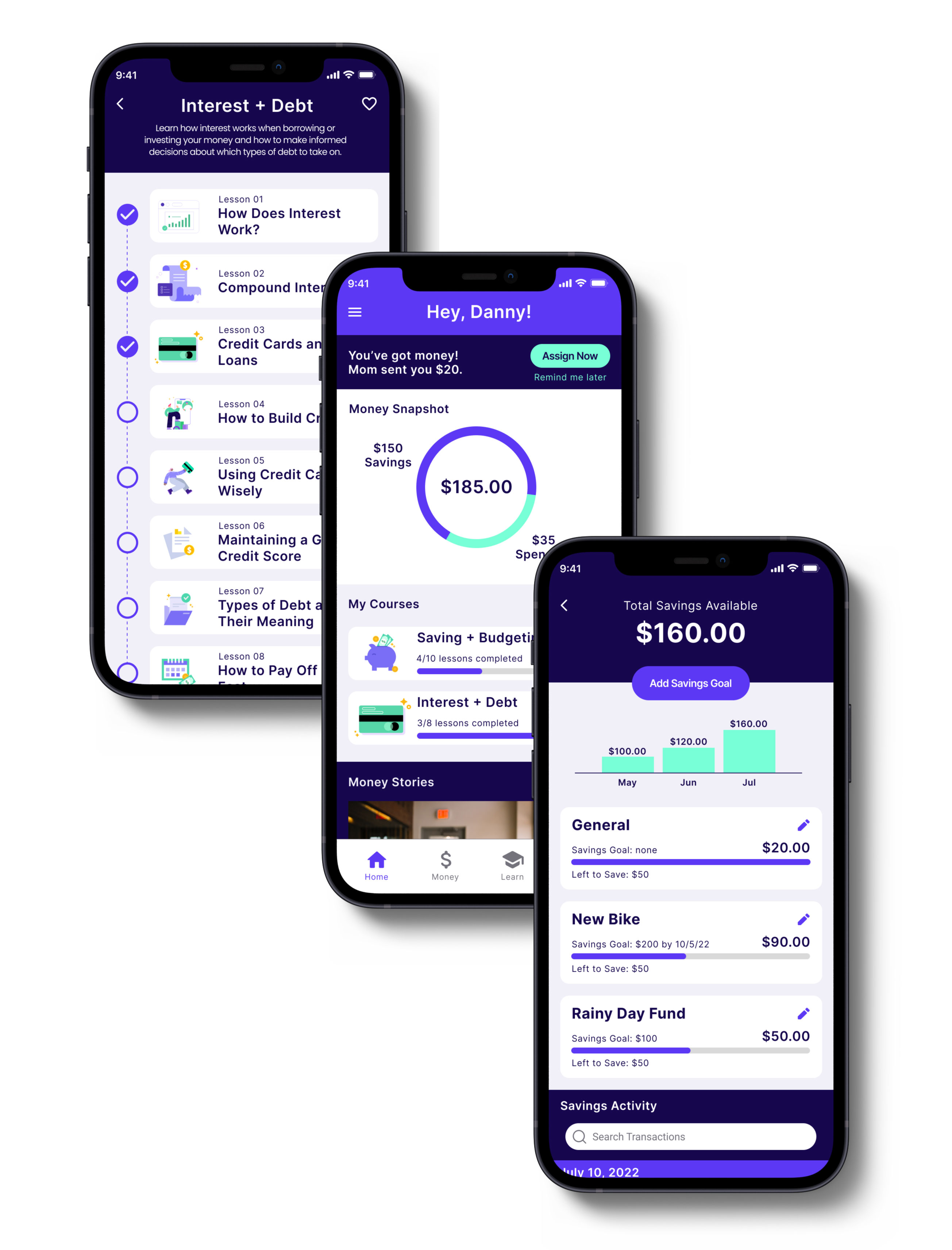

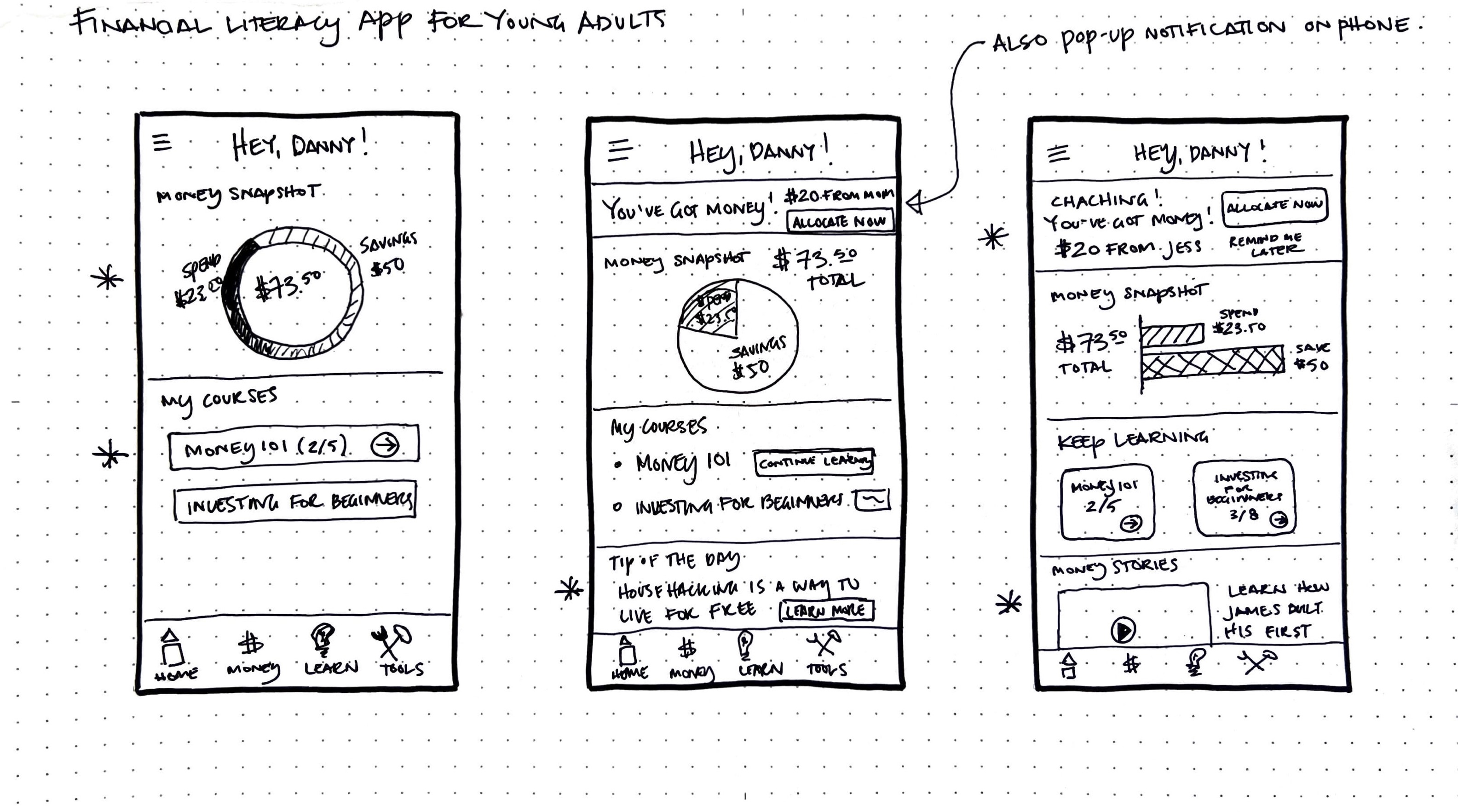

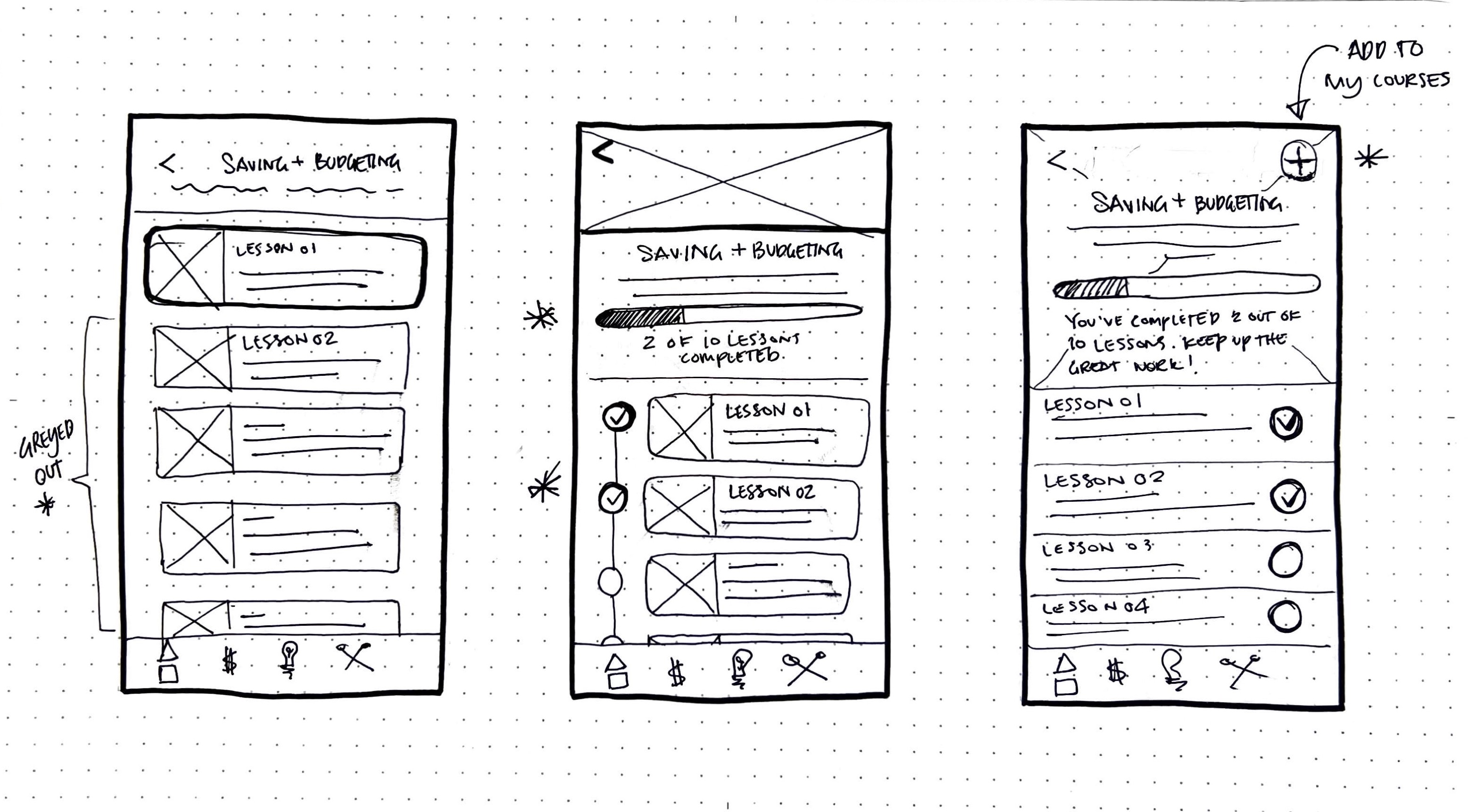

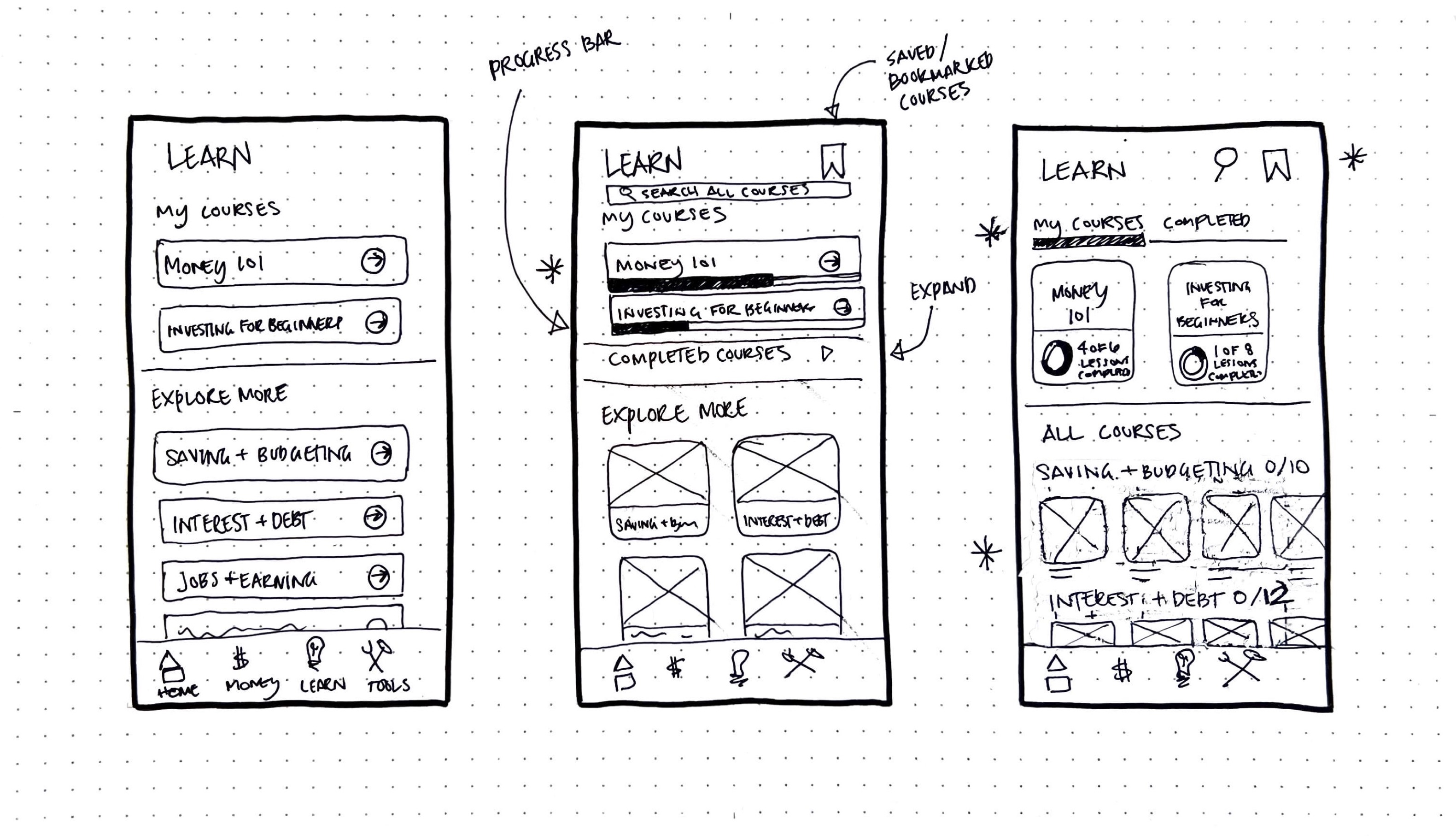

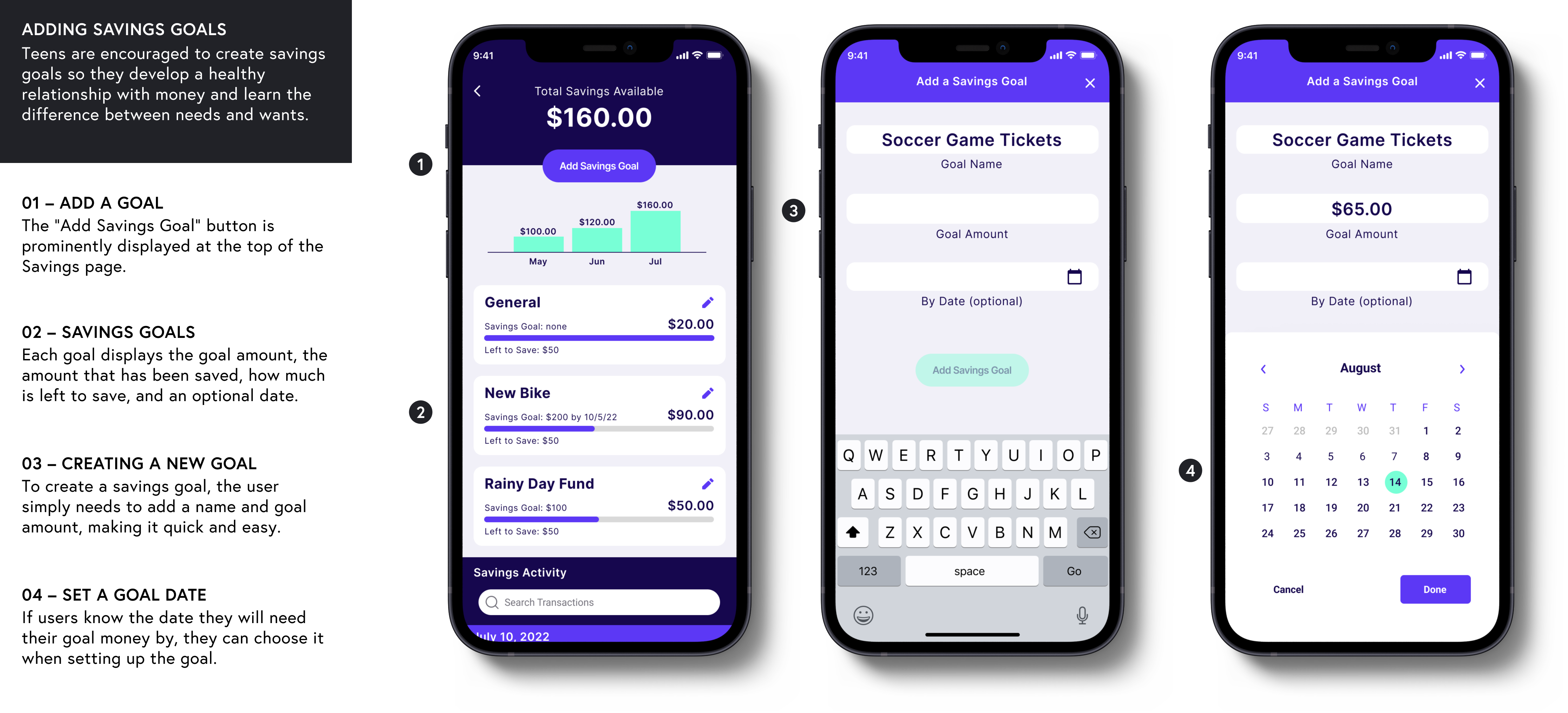

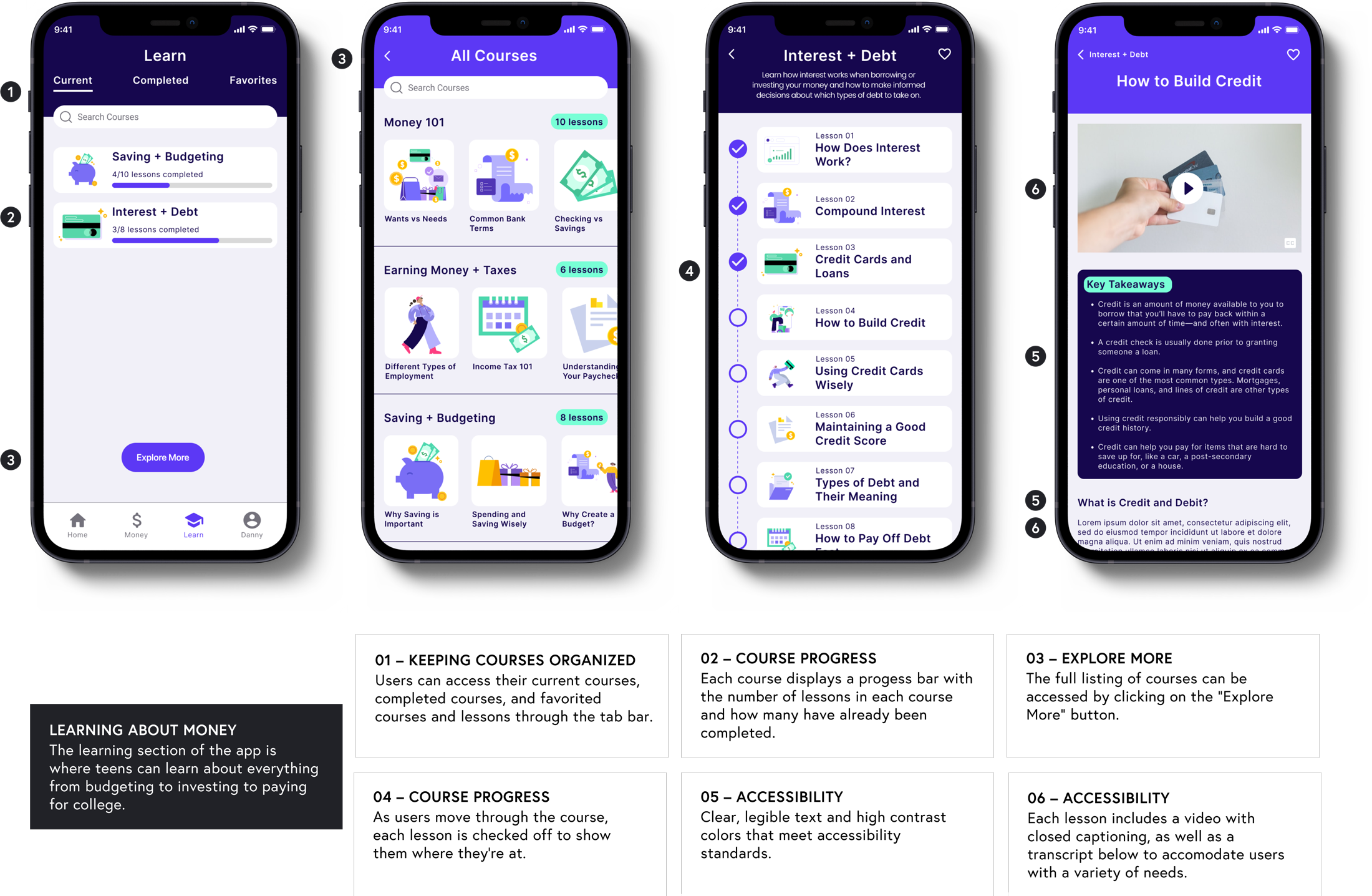

Based on my user research findings, I endeavored to design an app that would allow teens to learn about personal finance through daily, bite-sized lessons that would be taught in plain, relatable language, to manage any money they received from an allowance, job, or gift, and to create budgets and savings goals.

TEST & DEFINE

Usability Studies & Refinement

—

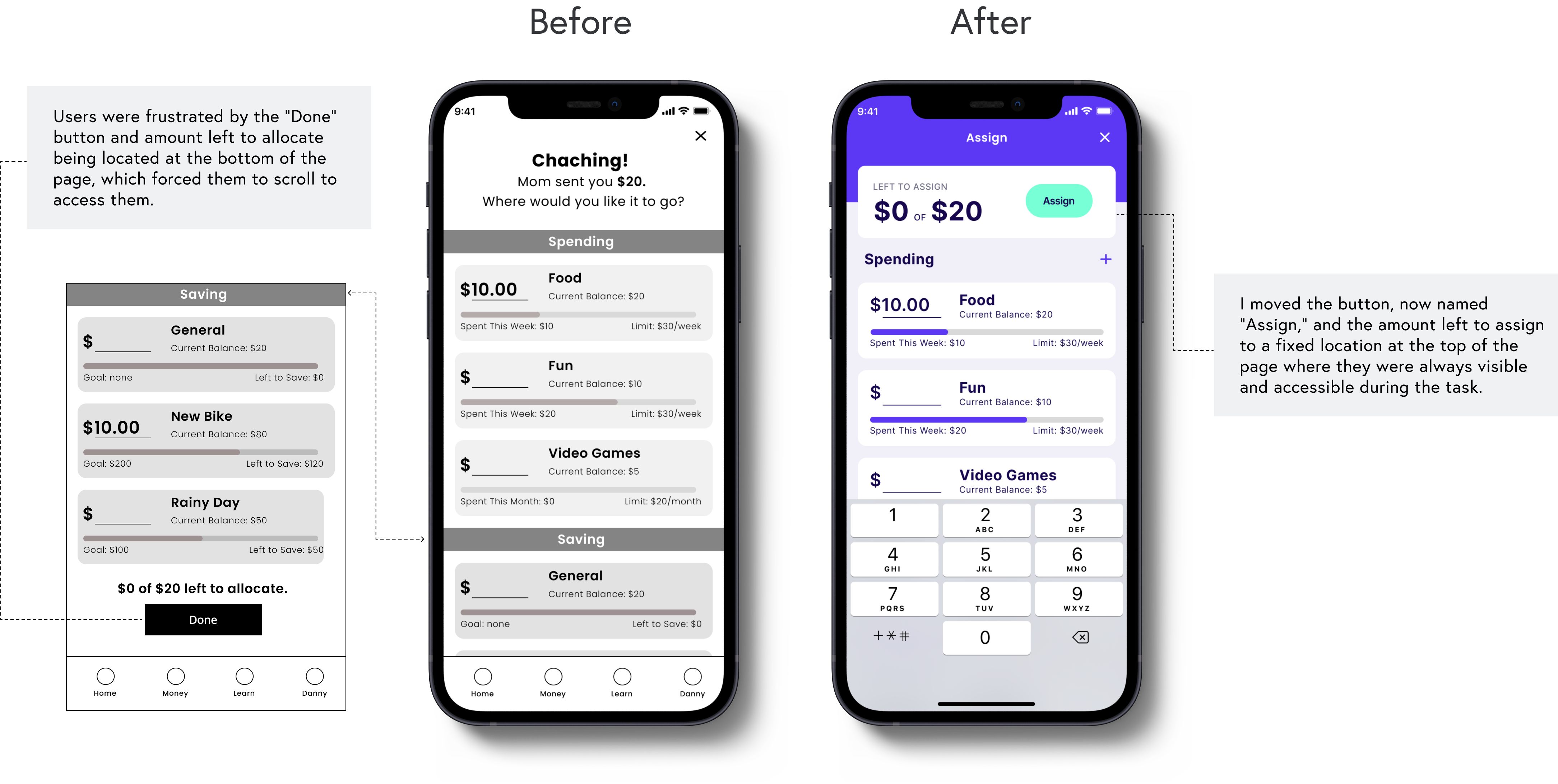

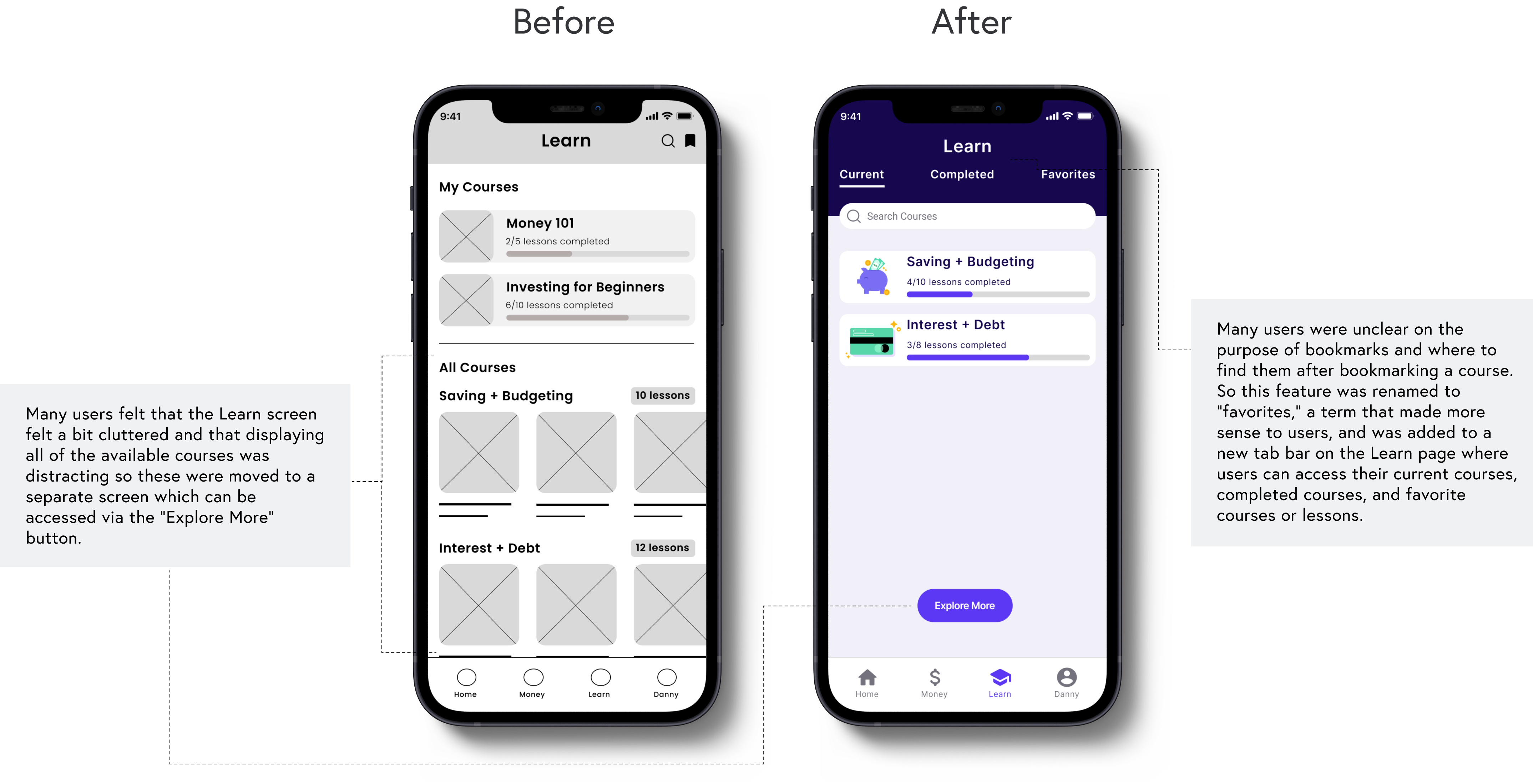

After conducting low-fidelity prototype usability studies with 5 participants, I organized their responses in an affinity diagram and looked for patterns. From there, I refined the design to better accommodate their needs and resolve their pain points.

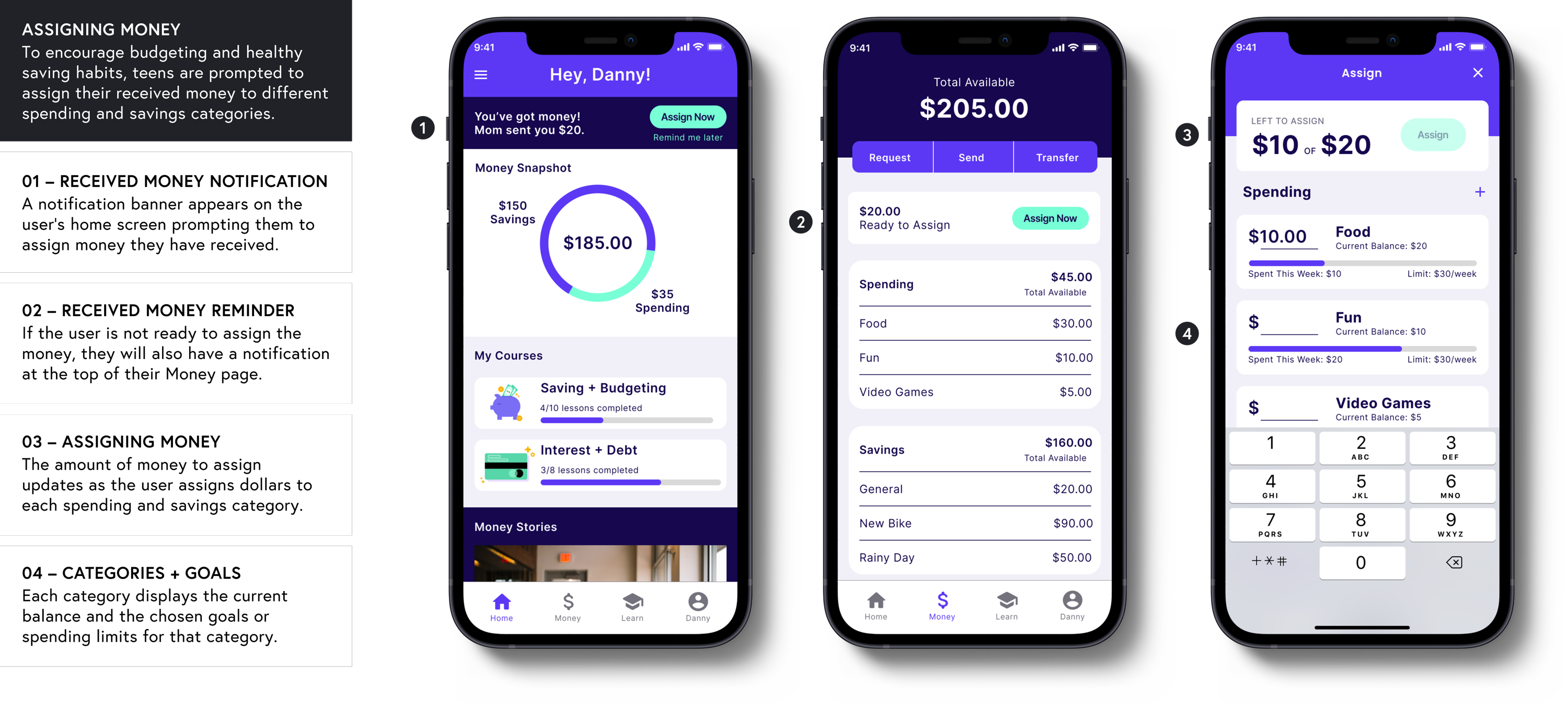

PROTOTYPE

Hi-Fi Mockups

—

PROTOTYPE

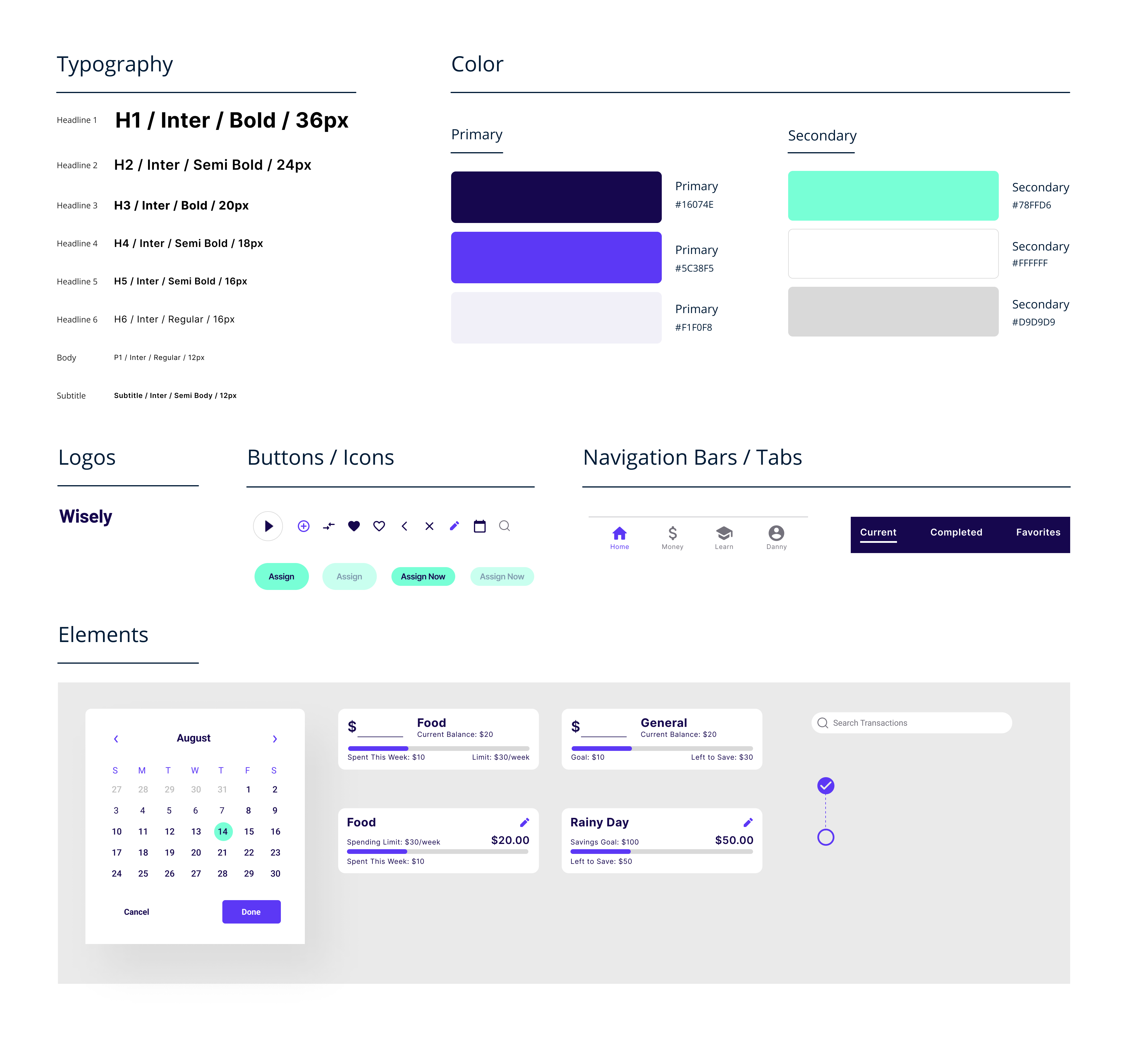

Design System

—

PROTOTYPE

Final Prototype

—

PROTOTYPE

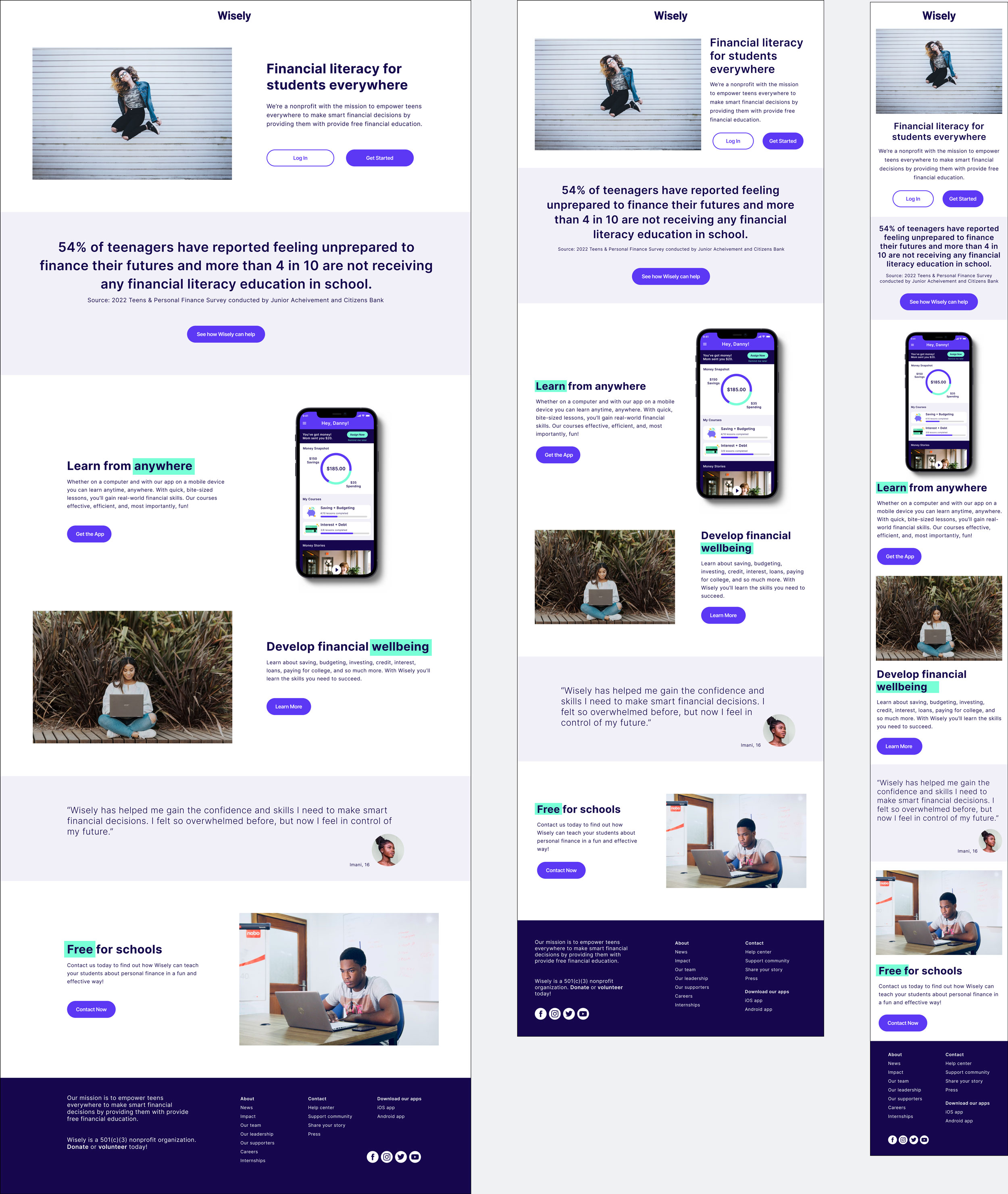

Responsive Web Design

—

To ensure that even teens without smartphones can access Wisely's education component and to make the app available to schools, there would also be a companion website where users could log in to their account to learn on the web. A variety of screen sizes were developed to make sure that users would have the best experience possible, regardless of device.

Key Takeaways

—

BE ADAPTABLE AND RESPONSIVE

Not all users will have access to smartphones so it is important to develop responsive designs that can work on a variety of devices – in the case of Wisely, an app that can be used on a mobile device and a website that can be accessed on a computer in a school or library. Meeting users where they're at is crucial to a product's success.

NEXT STEPS

I feel like I have only touched the surface with Wisely. If I had more time, I would work on developing the user dashboard for the website and would focus on making sure there was a seamless transition from the app to the website. I would also like to develop the onboarding experience for both the app and website.

CONNECT

daniellepecora@gmail.com | LinkedIn